Book Review of Bad Company: Private Equity and the Death of the Americ…

A Rage-Inducing Read: "Bad Company: Private Equity and the Death of the American Dream"

I’ve found myself drawn to bleak and thought-provoking non-fiction lately, and Megan Greenwell’s Bad Company: Private Equity and the Death of the American Dream is no exception. The title itself is a sharp invitation to reflect on a pressing issue: the shadowy world of private equity—or as some might more aptly call it, “vulture capitalism.” After watching Greenwell’s interview with Taylor Lorenz, where the conversation danced around corporate greed and its personal ramifications, I felt compelled to dive into this book. Yes, it’s depressing, but isn’t it time we confront the realities that shape our lives?

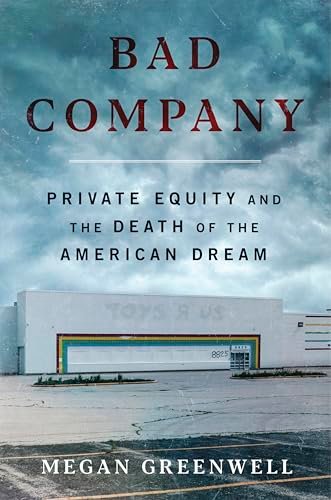

At its core, Bad Company chronicles the lives of four individuals whose careers and livelihoods have been irrevocably altered by vulture capitalism. We meet Liz, a former ToysRUs employee, Roger, a rural Wyoming doctor, Natalia, a journalist at Gannett, and Loren, an affordable housing advocate. Each of their stories unveils how the relentless machinery of private equity disrupts industries, often leaving people behind in favor of profit maximization. Greenwell does an exceptional job of weaving individual narratives with broader economic critiques. It’s one thing to understand private equity as a concept; it’s quite another to witness its impact on real people, making the book all the more resonant.

Greenwell’s writing style is clear and engaging, enabling readers to grasp complex economic principles while maintaining emotional engagement. She expertly balances facts with heartfelt anecdotes, showcasing the harsh realities faced by her subjects: job losses, diminishing healthcare access, and the ever-increasing monopolization of media. Her use of language is often biting yet compassionate, packing a punch with statements that left me feeling outraged and frustrated. There’s a specific moment in the book where Greenwell describes the corporate indifference to the destruction of communities—it’s a gut punch, one that resonates far beyond the pages.

One particularly memorable aspect of the narrative is how Greenwell reframes the traditional views on private equity. She doesn’t solely focus on the statistics; rather, she contextualizes them, revealing the human cost behind every number and chart. The sense of hopelessness, while real, gives way to a glimmer of hope toward the end. Greenwell discusses how communities can rally together to reclaim their autonomy, and this is where I felt a flicker of optimism amidst the despair. It’s a challenge, and perhaps an uphill battle, but the book offers a reminder of what can be achieved when people unite for a common cause.

While Bad Company leaves you grappling with the question of our collective future, it also serves as an urgent call to action. I found myself reflecting on my own role in this landscape of capitalism and the small changes I might contribute to effecting real transformation. Who should read this book? Anyone who ever felt defeated by systemic issues, activists fighting for economic justice, or simply those curious about the true underbelly of capitalism will find something valuable here.

In all honesty, this book is not just a read; it’s a necessary confrontation with a broken system. And despite the heaviness of its themes, my hope for meaningful change remains ignited. If you’re up for a challenging yet enlightening experience, Bad Company might just be the read you didn’t know you needed.

Discover more about Bad Company: Private Equity and the Death of the Americ… on GoodReads >>